Due to financial hardship leading on from the COVID pandemic, in Australia there was a ban on rent increases, and evictions due to non-payment of rent. This helped people a lot, along with Jobkeeper, and might be the first time our government took homelessness even slightly seriously.

Now the moratorium is ending, and many tenants have been reporting that their rent is increasing by a hundred dollars a week, others have not had their contracts renewed due to the houses going on the market. This is all to a backdrop of unheard of vacancy rates- my town’s is 0.5%- People don’t have anywhere to go.

People who own investment properties tend to say that this problem can be solved by renters buying property. This ignores the simple fact that not everyone has the steady income to get a home loan, or the ability to save up a deposit while paying half their income in rent. The only reason I can type this up in my own place is because my lovely and long-suffering parents lent me a sizable sum towards the deposit, which is a privilege most people don’t have.

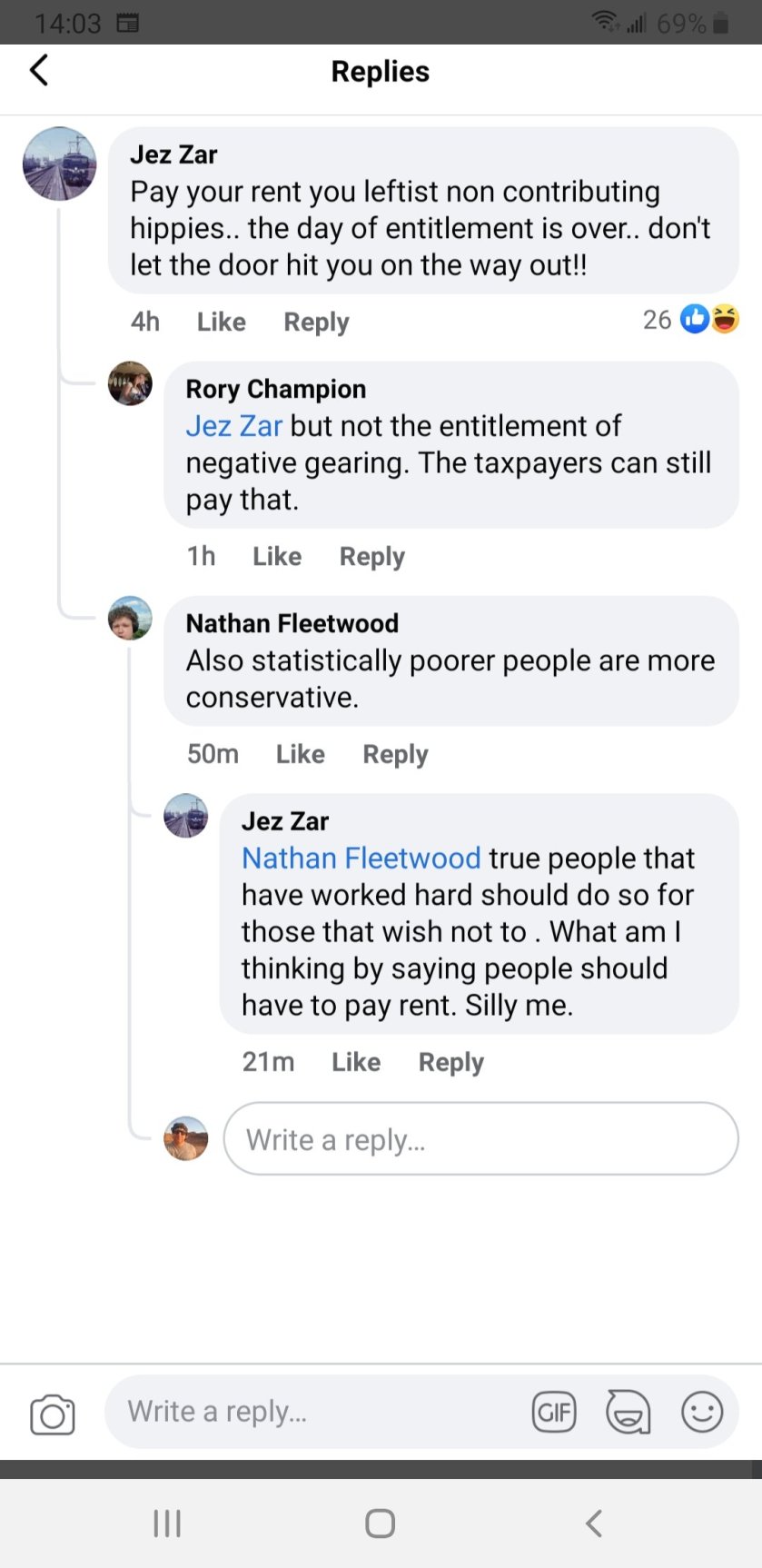

A cursory glance at the comments on any post about the rent increases and evictions will quickly educate a person that the majority of landlords are entirely unsympathetic to the plights of tenants. Landlords view themselves as responsible Aussie battlers, and tenants are careless dole bludgers. As a renter, you are at best considered a necessary evil, at worst scum of the Earth.

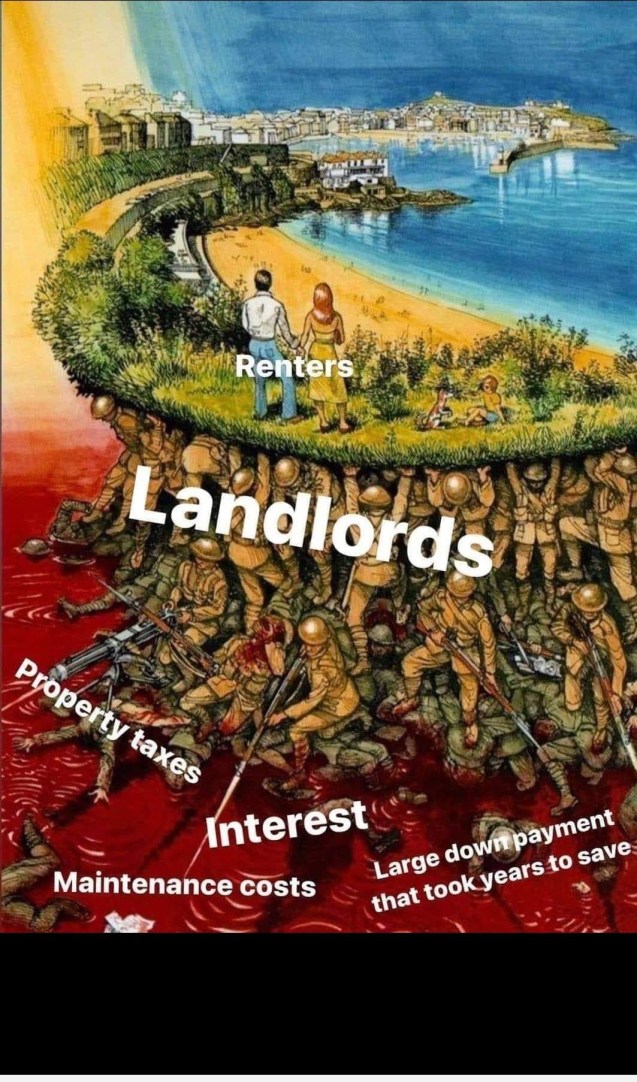

Its amazing how common the idea is that tenants have all the rights and landlords are passive and downtrodden. This completely ignores that few people choose to rent, and no one is forced to own investment property and to rent them out. If the investment doesn’t turn out, they can get out of the situation by selling up. What can the tenant do? Their choice is between homelessness and paying increasing percentages of their income on rent, hardly a choice at all.

Most people who own investment properties can only do so with the income from rent to cover a large percentage of the mortgage and other expenses of the property. This is fine during good times, and as long as rents remain affordable. Considering the massive debts involved in mortgages, this is a highly tenuous position in the best of times, yet landlords are shocked that people will have trouble paying rent during a pandemic. Meanwhile, if you told someone to get into debt for a figure multiple times their annual income for an investment that may or may not turn out in their favor, they would laugh in your face. This is how cult like investing in property seems to be.

Part of this problem is that for the last fifty years, governments, financial advisers, bank managers and every white person’s grandparents have been telling everyone that property is the best investment, and that property values will only ever go up. These ludicrous claims have been made on the back of people who try to get their own piece of the Australian dream, many of which fail. How this is not a pyramid scheme is mostly ignored. So you will have to forgive me for not joining in with the whole “Landlords are the cornerstone of society” bullshit.

The more you think about it, the more you will come to realize that things don’t have to be the way they are. The system heavily incentives property as investments over home ownership. We can change this, if the Australian people and the parasites we call politicians prioritize home ownership over profit.